Introduction

In the intricate domain of personal finance, methodical planning, and robust goal-setting frameworks are essential for achieving sustainable economic well-being. This exposition delves into the theoretical and applied dimensions of financial goal-setting, emphasizing empirically validated techniques for enduring fiscal discipline and wealth generation.

Table of Contents

Theoretical Foundations of Financial Goal-Setting

Financial goals transcend mere monetary benchmarks, representing complex interactions of individual priorities, values, and ambitions. Framing these objectives within broader socio-economic and psychological contexts enhances their effectiveness and relevance.

Systemic Benefits of Defining Financial Objectives

- Strategic Orientation: Clear goals provide a roadmap, transforming vague intentions like “save money” into quantifiable objectives, such as “accumulate ₹1,00,000 within 12 months for an emergency fund.”

- Intrinsic and Extrinsic Motivation: Defined milestones act as psychological motivators, counteracting cognitive biases and impulsive tendencies.

- Enhanced Accountability: Tangible metrics foster self-regulation, enabling adaptive strategies as circumstances evolve.

- Optimized Resource Allocation: Strategic goal-setting reduces inefficiencies, fostering prudent expenditure and disciplined savings.

- Psychological Empowerment: Incremental achievements establish a reinforcing cycle of self-efficacy and aspirational growth.

Advanced Frameworks for Financial Goal-Setting

1. Critical Self-Appraisal and Prioritization

Reflective inquiry is foundational:

- What are the existential and aspirational aspects of my financial goals?

- How will achieving these objectives reshape my socio-economic trajectory?

- What sacrifices am I willing to make to fulfill these ambitions?

2. Leveraging SMART Principles

- Specific: Define goals with precision, e.g., “save ₹2,00,000 for a home down payment in 24 months.”

- Measurable: Incorporate metrics, such as “set aside ₹8,333 monthly.”

- Achievable: Align targets with income patterns and expenditure constraints.

- Relevant: Ensure objectives resonate with personal and cultural priorities.

- Time-Bound: Establish timelines to assess and recalibrate as needed.

3. Temporal Stratification of Goals

- Immediate Goals (≤1 Year): Emergency savings or short-term liquidity reserves.

- Intermediate Goals (1–5 Years): Asset purchases, education funding, or entrepreneurial investments.

- Long-Term Goals (>5 Years): Retirement planning, generational wealth accumulation, or philanthropic endeavors.

4. Comprehensive Financial Diagnostics

- Conduct granular analyses of income, fixed versus variable expenses, and asset-liability ratios.

- Utilize predictive modeling tools to simulate cash flows, net worth projections, and risk scenarios.

5. Incremental Decomposition of Objectives

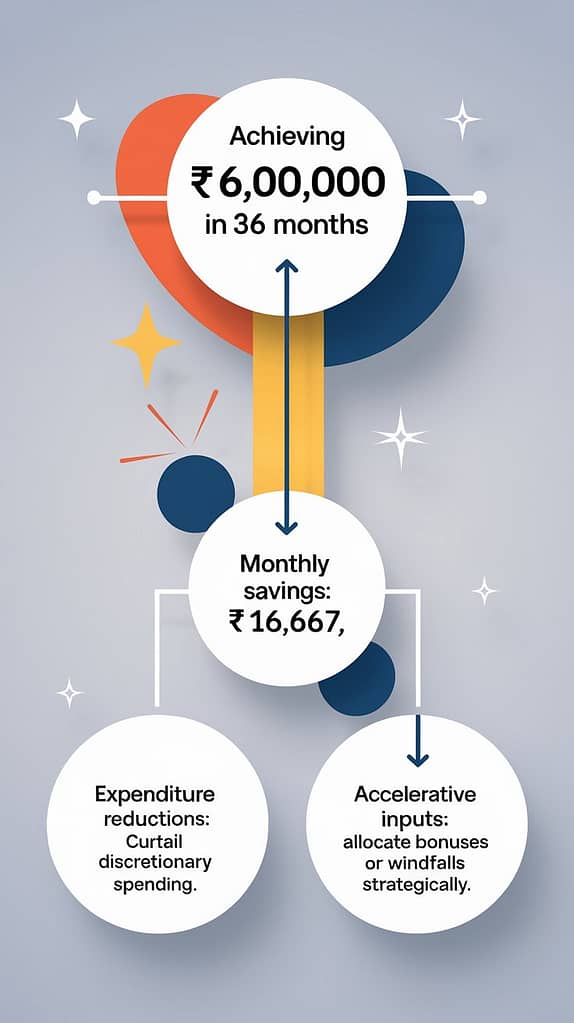

Illustration: Achieving ₹6,00,000 in 36 months requires:

- Monthly savings: ₹16,667.

- Expenditure reductions: Curtail discretionary spending.

- Accelerative inputs: Allocate bonuses or windfalls strategically.

Sustaining Momentum: Advanced Strategies for Goal Adherence

1. Dynamic Monitoring and Feedback

- Employ AI-powered dashboards for real-time tracking.

- Schedule quarterly reviews to integrate economic shifts into financial strategies.

2. Automating Savings Mechanisms

- Establish automatic transfers to high-yield accounts.

- Explore robo-advisory platforms for optimized investment allocation.

3. Reinforcing Progress Through Rewards

- Celebrate milestones with rewards aligned to broader goals.

- Avoid counterproductive incentives that could derail progress.

4. Leveraging Social Accountability

- Engage with accountability groups or mentors for sustained focus.

- Participate in financial literacy forums to exchange strategies and insights.

Empirical Case Studies: Insights from the Indian Context

Ramesh: Achieving Aspirations through Incremental Discipline

Ramesh, a high school teacher, saved ₹2,50,000 over three years by:

- Conducting meticulous expense audits.

- Investing in fixed deposits with cumulative interest.

- Supplementing income through tutoring.

Priya: Financing a Debt-Free Wedding

Priya, a Bengaluru-based software engineer, accomplished her financial goal by:

- Allocating funds to a dedicated wedding account.

- Budgeting granularly for event-specific expenditures.

- Utilizing cashback schemes and vendor negotiations.

Common Pitfalls in Financial Planning

- Overextension of Ambitions: Unrealistic goals undermine motivation.

- Emergency Buffer Neglect: Ignoring contingencies disrupts plans.

- Inflationary Oversights: Failure to factor inflation skews projections.

- Rigidity in Execution: Overly rigid strategies hinder adaptability.

Advanced Resources for Financial Management

Cutting-Edge Tools

- Budgeting Apps: YNAB, Goodbudget.

- Investment Platforms: Zerodha Varsity, INDmoney.

Foundational Literature

- Housel, M. (2020). The Psychology of Money.

- Kiyosaki, R. (1997). Rich Dad Poor Dad.

Institutional Resources

- Reserve Bank of India (RBI) financial literacy initiatives.

- SEBI investor education programs.

Implementing Knowledge: Practical Steps

- Download our Comprehensive Financial Checklist.

- Explore related articles: Strategic Budgeting Frameworks.

- Share progress stories in our community forums.

- Seek tailored advice from certified financial planners.

Conclusion

Strategic financial goal-setting is indispensable for fostering autonomy and resilience. By embracing the methodologies detailed herein, individuals can systematically transform ambitions into measurable achievements. Embark on your financial journey today to establish a legacy of stability and empowerment.