Introduction

Achieving Financial Freedom in your 20s and 30s might seem impossible, but it’s far more attainable than you think. Financial Freedom means having enough wealth to cover your living expenses without relying on a paycheck. It’s about creating a life where money works for you, giving you the freedom to pursue passions, spend time with loved ones, or even retire early.

Starting early is your golden ticket. The earlier you build smart financial habits, the longer your money has to grow. Ready to take charge of your future? Let’s dive into these 10 powerful steps to secure financial Freedom.

Table of Contents

1. Understand Your Financial Goals

Before you can achieve Financial Freedom, you need to know what it means to you. For some, it’s early retirement; for others, it’s simply being debt-free and having savings to handle any crisis.

Identify What Financial Freedom Means to You

Sit down and list your financial aspirations. Is it owning a home by 30? Traveling the world without worrying about expenses? Be specific—your goals shape your roadmap.

Short-Term vs. Long-Term Goals

Divide your goals into short-term (saving for a car, paying off credit cards) and long-term (retirement planning, building wealth). This approach gives clarity and prevents overwhelm.

2. Build a Budget and Stick to It

Importance of Tracking Income and Expenses

A budget is the cornerstone of Financial Freedom. It shows you where your money is going and where you can cut back. Without it, your goals remain dreams.

Tips for Creating a Realistic Budget

- Use the 50/30/20 rule: 50% for needs, 30% for wants, 20% for savings or debt repayment.

- Keep it flexible. Life changes—your budget should, too.

Tools and Apps for Managing Your Finances

Apps like Mint, YNAB (You Need a Budget), and PocketGuard make budgeting easy and even fun.

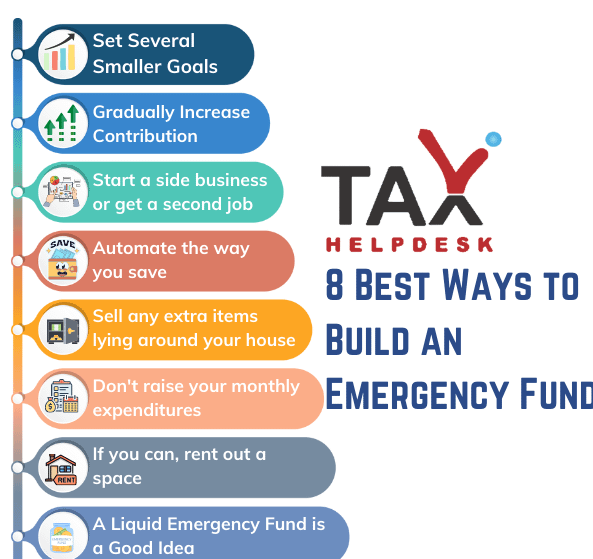

3. Create an Emergency Fund

Why an Emergency Fund is Essential

Life is unpredictable—medical emergencies, job losses, or car breakdowns can derail your plans. An emergency fund is your financial safety net.

How Much to Save

Aim for 3-6 months’ worth of living expenses. Start small—saving even ₹500 a month builds momentum.

Steps to Start and Grow Your Fund

- Open a dedicated savings account.

- Automate monthly transfers to make saving effortless.

- Use bonuses or windfalls to give it a boost.

4. Eliminate Debt Strategically

Debt can cripple your path to Financial Freedom. But not all debt is created equal.

Understanding “Good” vs. “Bad” Debt

Good debt, like a student loan, can be an investment in your future. Bad debt, like high-interest credit cards, should be tackled aggressively.

Debt Snowball vs. Debt Avalanche Method

- Debt Snowball: Pay off the smallest debts first to build momentum.

- Debt Avalanche: Tackle debts with the highest interest rates first to save money.

Avoiding Future Debt Traps

Stay disciplined with credit. If you can’t pay for it in cash, reconsider the purchase.

5. Invest in Your Future

Basics of Investing for Beginners

Investing is how you make your money grow. Start with a low-risk option, like index funds, and gradually diversify.

Types of Investment Options

- Stocks: High potential for growth, but risky.

- Real Estate: A long-term, tangible asset.

- Mutual Funds: A balanced option for beginners.

Compounding Interest and Its Power

Think of compounding as planting a tree—your money grows exponentially the longer it’s invested.

6. Increase Your Income Streams

Why Relying on One Income is Risky

One job isn’t always enough. Diversifying income protects you during tough times.

Side Hustles and Freelancing Ideas

Explore skills like writing, graphic design, or teaching online. Platforms like Upwork or Fiverr can get you started.

Passive Income Opportunities

Invest in dividend-paying stocks, rent out property, or start a blog to generate passive income.

7. Live Below Your Means

Understanding Needs vs. Wants

Ask yourself: Do I need this, or do I just want it? This mindset shift can save you thousands.

Minimalist Lifestyle Benefits

Minimalism isn’t about deprivation—it’s about focusing on what truly matters.

Ways to Cut Unnecessary Expenses

Cook at home, cancel unused subscriptions, and embrace second-hand shopping.

8. Continuously Educate Yourself About Money

Best Personal Finance Books

Books like “Rich Dad Poor Dad” by Robert Kiyosaki or “The Total Money Makeover” by Dave Ramsey offer valuable insights.

Online Resources and Courses

Websites like Investopedia or courses on platforms like Coursera can expand your knowledge.

Learning from Financial Mentors

Find mentors who’ve achieved Financial Freedom and learn from their experiences.

9. Plan for Retirement Early

Benefits of Starting in Your 20s and 30s

The earlier you start, the more time your investments have to grow.

Retirement Account Options

Explore PPF (Public Provident Fund), NPS (National Pension Scheme), or EPF (Employees’ Provident Fund) in India.

Setting Realistic Retirement Savings Goals

Calculate your desired lifestyle expenses and work backward to determine savings needs.

10. Protect Your Wealth

Importance of Insurance

Insurance safeguards against unforeseen events. Don’t skimp on health, life, or disability insurance.

Estate Planning Basics

Create a will, name beneficiaries, and ensure your loved ones are cared for.

Preventing Financial Fraud

Be cautious with online transactions and avoid sharing sensitive information.

Conclusion

Achieving Financial Freedom in your 20s and 30s requires focus, discipline, and a clear plan. Each step builds upon the other, creating a solid foundation for a secure financial future. Remember, small changes today lead to monumental gains tomorrow. Start now—your future self will thank you.

FAQs

1. What is the ideal amount for an emergency fund?

The ideal amount is 3-6 months of your living expenses. If your job is unstable, aim for the higher end.

2. How can I start investing with little money?

3. What are the best ways to save for retirement in your 20s?

Start with a PPF or NPS account. Automate contributions and increase them annually as your income grows.

4. How do I find legitimate passive income ideas?

Research platforms like Airbnb, YouTube, or Stock Photography websites to find credible passive income sources.

5. Why is Financial Freedom important?

It gives you freedom—freedom from debt, freedom to choose how you spend your time, and freedom to live life on your terms.